It’s an obvious statement that car insurance companies don’t want you to look for cheaper rates. Consumers who shop for lower prices are highly likely to buy a new policy because of the good chance of finding better rates. A survey found that consumers who made a habit of comparing rates saved over $72 a month as compared to drivers who never shopped around for better prices.

If finding the cheapest rates on car insurance is your goal, understanding how to shop for insurance rates can make the process more efficient.

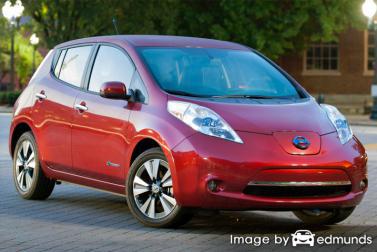

Really, the only way to find affordable quotes for Nissan Leaf insurance is to start doing an annual price comparison from insurance carriers in Cleveland.

Really, the only way to find affordable quotes for Nissan Leaf insurance is to start doing an annual price comparison from insurance carriers in Cleveland.

First, try to learn about how companies set rates and the changes you can make to keep rates down. Many things that result in higher rates such as traffic tickets, fender benders, and a substandard credit score can be eliminated by improving your driving habits or financial responsibility.

Second, get rate quotes from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only give prices from one company like GEICO or State Farm, while independent agencies can provide price quotes from multiple sources. View insurance agents

Third, compare the new rate quotes to your current policy premium to see if cheaper Leaf coverage is available in Cleveland. If you find a better price, make sure there is no lapse between the expiration of your current policy and the new one.

Fourth, tell your current agent or company to cancel the current policy. Submit a completed application and payment to your new insurance company. Immediately place the new certificate verifying coverage with the vehicle registration.

The most important part of shopping around is that you’ll want to make sure you compare identical limits and deductibles on every quote request and and to analyze as many car insurance companies as possible. This helps ensure a fair price comparison and a better comparison of the market.

Buying the cheapest insurance in Cleveland is much easier if you know where to start. If you already have coverage or just want cheaper coverage, you can learn to save money without reducing coverage. Vehicle owners just need to learn the quickest method to compare company rates on the web.

Low cost Cleveland Nissan Leaf insurance

Most major insurance companies such as GEICO, State Farm and Progressive allow you to get insurance quotes directly from their websites. Comparing Nissan Leaf insurance rates online is easy for anyone as you simply type in your coverage preferences into the quote form. Upon sending the form, the quote system pulls your credit score and driving record and provides a quote. The ability to get online rates for Nissan Leaf insurance in Cleveland simplifies rate comparisons, and it is imperative to do this in order to get cheaper car insurance pricing.

If you want to compare pricing, compare rates from the companies below. If you have coverage now, it’s recommended you copy the coverages as shown on your current policy. Using the same limits helps guarantee you are getting an apples-to-apples comparison for exact coverage.

The companies shown below are our best choices to provide price quotes in Cleveland, OH. If you want cheap auto insurance in OH, we suggest you visit several of them to get a more complete price comparison.

Best reasons to buy auto insurance in Ohio

Despite the high insurance cost for a Nissan Leaf in Cleveland, insuring your vehicle is required in Ohio but also provides important benefits.

- Almost all states have mandatory insurance requirements which means it is punishable by state law to not carry specific limits of liability insurance coverage in order to license the vehicle. In Ohio these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you took out a loan on your vehicle, most lenders will require you to buy full coverage to ensure loan repayment if the vehicle is totaled. If you default on your policy, the lender may insure your Nissan at a much higher premium rate and require you to pay for the expensive policy.

- Insurance protects both your assets and your Nissan. It will also reimburse you for most medical and hospital costs for you, any passengers, and anyone injured in an accident. One of the most valuable coverages, liability insurance, also pays expenses related to your legal defense if you are named as a defendant in an auto accident. If your car is damaged in a storm or accident, your policy will pay to repair the damage minus the deductible amount.

The benefits of having insurance greatly outweigh the cost, especially for larger claims. According to a survey of 1,000 drivers, the average driver is wasting up to $700 annually so compare rates once a year at a minimum to make sure the price is not too high.

Cleveland insurance discounts for a Nissan Leaf

Not many people think insurance is cheap, but you can get discounts that could drop your premiums quite a bit. A few discounts will be applied at the time of purchase, but some must be specially asked for before you will receive the discount. If you do not check that you are getting every discount available, you could be paying more than you need to.

- Student Discounts – This discount can get you a discount of up to 25%. Most companies allow this discount up until you turn 25.

- Military Discounts – Being on active deployment in the military could be rewarded with lower prices.

- Multi-line Discount – Some auto insurance companies give a lower rate if you buy life insurance.

- Good Driver Discounts – Insureds without accidents may save up to 50% more than their less cautious counterparts.

- Claim Free – Good drivers with no accidents have much lower rates when compared with frequent claim filers.

- Buy New and Save – Insuring a vehicle that is new may earn a small discount due to better safety requirements for new model year vehicles.

You can save money using discounts, but some credits don’t apply to the entire cost. Most cut the price of certain insurance coverages like medical payments or collision. So even though they make it sound like having all the discounts means you get insurance for free, that’s just not realistic.

The best auto insurance companies and a partial list of their discounts are shown below.

- Travelers offers discounts including home ownership, continuous insurance, save driver, payment discounts, and hybrid/electric vehicle.

- 21st Century may include discounts for anti-lock brakes, student driver, theft prevention, homeowners, automatic seat belts, and defensive driver.

- State Farm discounts include good student, multiple autos, Drive Safe & Save, student away at school, and multiple policy.

- GEICO has discounts for defensive driver, air bags, seat belt use, multi-policy, and emergency military deployment.

- SAFECO may offer discounts for teen safety rewards, bundle discounts, homeowner, safe driver, and accident prevention training.

- AAA has savings for education and occupation, AAA membership discount, good driver, anti-theft, and multi-policy.

If you want low cost Cleveland car insurance quotes, ask all companies you are considering which discounts they offer. A few discounts may not be offered in your area. To see insurance companies who offer online Nissan Leaf insurance quotes in Ohio, click here.

Get rate quotes but buy from a local Cleveland insurance agency

Many drivers still prefer to buy from a licensed agent and there is nothing wrong with that. Professional agents can help determine the best coverages and help you file claims. One of the great benefits of comparing insurance prices online is that you can find the lowest rates but still work with a licensed agent.

For easy comparison, once you complete this quick form, your insurance data is immediately sent to agents in your area who will give you bids for your car insurance coverage. It’s much easier because you don’t need to find an agent as quotes are delivered straight to your inbox. If you have a need to get a comparison quote from one company in particular, you can always find their quoting web page and give them your coverage information.

Choosing an insurer requires you to look at more than just the bottom line cost. Here are some questions you should ask.

- How many years of experience in personal auto insurance do they have?

- Will the company cover a rental car if your car is getting fixed?

- Which insurance company do they prefer to write with?

- Are they able to influence company decisions when a claim is filed?

- Do the coverages you’re quoting properly cover your vehicle?

- What is their Better Business Bureau rating?

- Are they giving you every discount you deserve?

When finding a reliable insurance agency, it’s important to understand the types of insurance agents and how they can quote your rates. Agents can be classified as either independent agents or exclusive agents. Both properly insure your vehicles, but it is a good idea to know how they are different since it could factor into your selection of an agent.

Exclusive Insurance Agents

Exclusive agencies write business for a single company such as Farmers Insurance, Allstate, or State Farm. Exclusive agents are unable to provide rate quotes from other companies so if the price isn’t competitive there isn’t much they can do. Exclusive insurance agents are highly trained on the products they sell which helps them compete with independent agents.

Shown below is a short list of exclusive agencies in Cleveland who can help you get price quotes.

Allstate Insurance: Eslick Insurance and Financial Services

2775 S Moreland Blvd Ste 203 – Cleveland, OH 44120 – (216) 283-5570 – View Map

Franklin Myles – State Farm Insurance Agent

3970 Mayfield Rd – Cleveland Heights, OH 44121 – (216) 291-9892 – View Map

State Farm: Betsy Warner

2491 Lee Blvd – Cleveland Heights, OH 44118 – (216) 932-6900 – View Map

Independent Agents

Independent agents do not work for one specific company so they have the ability to put coverage with multiple insurance companies and find the cheapest rate. If prices rise, they can switch companies in-house and you don’t have to do anything. When comparing car insurance prices, we recommend you contact a couple of independent agencies to get the best comparison.

Shown below is a short list of independent agents in Cleveland that are able to give comparison quotes.

Pilat Insurance Agency, Inc.

5925 Ridge Rd – Cleveland, OH 44129 – (440) 888-1150 – View Map

Anthony Insurance

508 E 185th St – Cleveland, OH 44119 – (216) 531-5555 – View Map

Select Insurance Services Agency, Inc.

12608 State Rd – Cleveland, OH 44133 – (440) 237-8555 – View Map

Ohio auto insurance companies ranked

Ending up with the highest-rated company can be a challenge considering how many different companies insure vehicles in Ohio. The company rank data in the lists below could help you analyze which car insurance companies you want to consider when shopping around.

Top 10 Cleveland Car Insurance Companies Ranked by Claims Service

- Progressive

- Travelers

- Liberty Mutual

- Nationwide

- USAA

- AAA Insurance

- GEICO

- Safeco Insurance

- Mercury Insurance

- Esurance

In conclusion

As you go through the steps to switch your coverage, never reduce needed coverages to save money. There are many occasions where an insured dropped full coverage to discover at claim time that they should have had better coverage. The goal is to get the best coverage possible at the best possible price, but do not sacrifice coverage to save money.

Some insurance companies do not offer internet price quotes and usually these smaller providers provide coverage only through independent insurance agencies. Cheaper car insurance in Cleveland is available from both online companies and also from your neighborhood Cleveland agents, so you should compare both in order to have the best chance of saving money.

Much more information about car insurance in Ohio can be found at the links below

- Distracted Driving Statistics (Insurance Information Institute)

- How Much is Auto Insurance for State Employees in Cleveland? (FAQ)

- Who Has Affordable Car Insurance Rates for Drivers Under 21 in Cleveland? (FAQ)

- Distracted Driving Extends Beyond Texting (State Farm)

- Bodily Injury Coverage (Liberty Mutual)

- Information for Teen Drivers (GEICO)

- Auto Insurance 101 (About.com)